What is the Setoff Debt Program?

Delinquent debts owed to organizations can introduce uncertainty into the budget process. This causes financial stress, stretches resources and creates a disproportionate responsibility for those individuals who pay their fair share. The Municipal Association helps cities and other participating entities alleviate their delinquent debts by offering free participation in the Setoff Debt Program.

How does the Setoff Debt Program work?

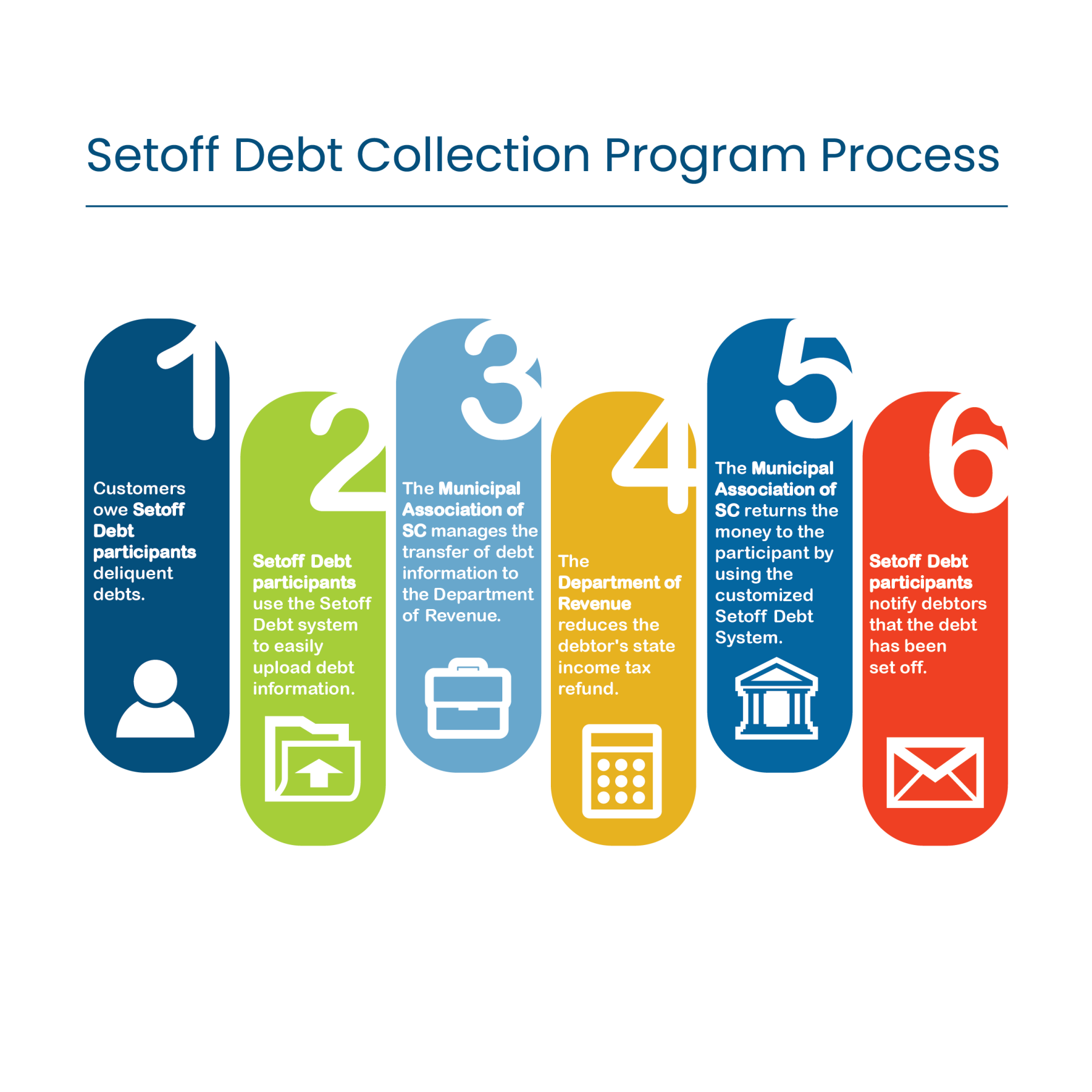

Each December, the Association compiles and forwards to the Department of Revenue a database of delinquent accounts and debts owed to participating municipalities and other entities (authorized by the 1992 amendment to the Setoff Debt Collection Act). The Municipal Association’s Setoff Debt Program allows cities to simplify their processes for collecting these delinquent debts and significantly reduces their staff time to manage multiple reporting requirements.

What is a debtor?

A debtor is any individual having a delinquent debt or account with any claimant agency which has not been adjusted, satisfied or set aside by court order, or discharged in bankruptcy.

What constitutes a delinquent debt?

A delinquent debt is any sum due and owed any claimant agency. It includes the collection costs, court costs, fines, penalties and interest which have accrued regardless of whether an effort has or is already being made to collect the sum. Examples include delinquent property taxes, rent, utility bills, parking fines, tuition fees, garbage fees, property damage costs, etc.