After years of debate and many pages of ethics reform proposals, the General Assembly passed legislation that adds new reporting requirements for anyone who must file a Statement of Economic Interests.

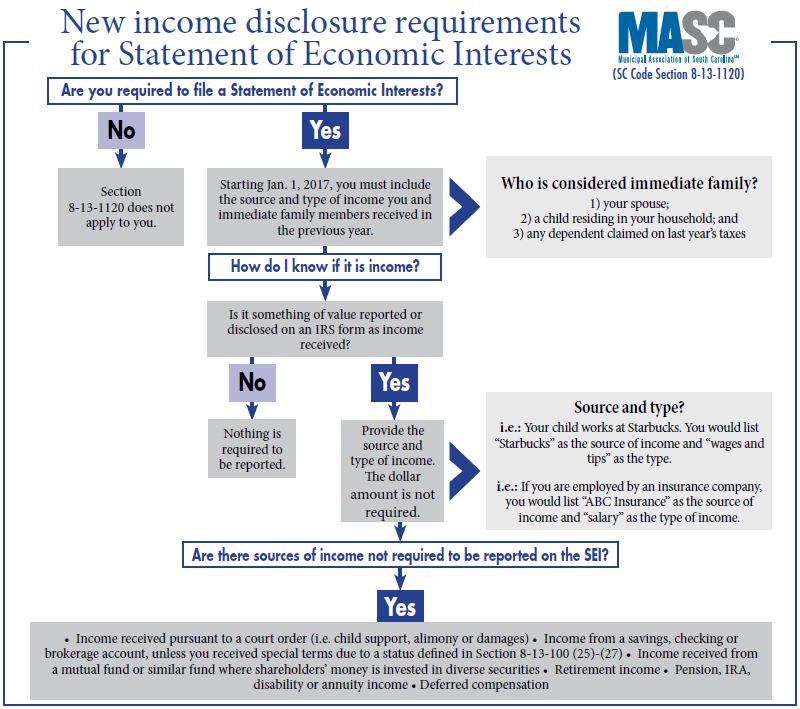

Starting in January, an official who is required to file a Statement of Economic Interests must include the source and type of income received during the previous year. This includes income received by the official and his immediate family.

Current law defines immediate family simply as the filer’s spouse, any child living in the filer’s household and anyone the filer claimed on his taxes during the previous year. The question of income, however, is more complicated.

The new law first defines income as anything of value received by the filer or his immediate family that would be listed on an IRS form filed for the disclosure of income. Then, it provides a lengthy list of sources or types of income that are expressly excluded from the definition, including retirement, annuity, pension, IRA, disability or deferred compensation payments.

To make understanding and following the new law easier, the Municipal Association has developed a flowchart to walk filers through its requirements.